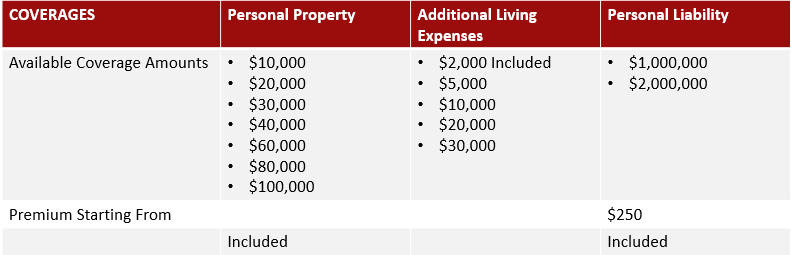

The owner has landlord insurance which specifically covers damage to their property and certain belongings. The minimal recommended coverage is 100000 but we suggest you get at least 1 million.

Understanding Your Rights As A Tenant In Alberta Arrive

If you can afford it go for 2 million.

. How does tenant insurance work in Alberta. Tenants insurance is also a great way to protect your belongings if they are damaged by fire stolen or vandalizedeven if theyre being stored elsewhere. Contents Insurance covers loss or damage to your property due to a insured risk.

That includes anything not owned by the landlordanything you move in with and will take. With tenant insurance you can get coverage for your belongings living expenses to cover hotel costs if necessary and liability protection in case a. A similar picture can be seen with tenants insurance in Alberta.

Get a tenant insurance quote. Our tenant insurance plan covers your belongings and includes liability coverage. It also protects you in case someone injures themselves or their property in your unit and wants to recoup their expenses.

It is your landlords responsibility to insure the building only. All-Risk means your property is covered against any loss or damage unless specifically excluded from your policy like intentional damage. Industry pros explain how it works and offer answers to your questions.

Here are a few basic terms to understand when it comes to tenants insurance. Weve proudly protected Canadians at home and on the road with insurance coverage that puts your needs first. Clothes including expensive purses or jackets Textbooks that can quickly add up to hundreds of dollars Electronics like digital cameras headphones iPhones iPads and laptops.

In Alberta Canadians pay an average of 59 a month for insurance while Ontarians pay 47 per month. Tenant insurance is for people who rent an apartment house or unit and it covers the tenants contents. Your tenant insurance will cover your own belongings including your furniture furnishings decor items clothes etc.

Tenant insurance policies from Square One also protect against accidental personal and property damage to others. Protect the contents of your rental home with tenants insurance from Intact Insurance Canadas largest home auto and business insurance company. Your landlords coverage doesnt protect your belongings as the renter.

The answer is in Alberta Tenant Insurance covers a wide range of valuables that you most likely own including. Tenant insurance works together with landlord insurance to make sure both the owner and the renter are protected. This includes your belongings inside your unit as well as in any designated locker or storage in your building Personal Liability In the event someone is hurt while at your home or you unintentionally injure someone or damage their property Additional Living Expenses.

Its an easy and affordable way to protect your investment in your personal property. Coverage for sewer backup. Its included in all home insurance policies including tenants insurance and protects you if youre held liable for damages involuntarily caused to a building or another person.

Tenants Insurance is designed to cover what you own even if you dont own your home. Typically it includes three parts. Tenant insurance is coverage that protects you and your personal items if you rent your home.

Tenant insurance provides you with protection against liability. You can depend on us for personal service exceptional insurance coverage customizable. Ways to Save on Tenant Insurance in Alberta Customers 50 years of age or older Claims Free Local Alarm Monitored Alarm Sprinkler System Water Leak Detection Device Multipolicy Increase in Deductible Claims Example Water damage is the most common claim we see when it comes to tenants.

Tenant insurance could cover your belongings against common risks such as theft fire loss and much more. Your landlord home insurance policy can include coverage for. On average Alberta tenant insurance premiums sit close to 25 per month whereas Ontarians pay on average 21 a month for their rental home insurance.

Buying the right insurance is an important step in taking care of your belongings. Tenant insurance also known. With over 65 years of experience in the insurance market you can trust that Allstate is the right choice for your tenant insurance in Alberta.

Whatever your needs well get you covered. Learn More Tenant-specific coverages As a tenant you may have the opportunity to make modifications your unit. Coverage for personal liability This kind of coverage can provide you with protection in case accidental damage is caused to another person or his property because of negligence on your part.

Tenant insurance is for protecting all your things that your landlords building and property insurance do not cover. These optional coverages are available to help you protect any upgrades. Additional living expenses Say you make a claim because the pipe burst and you have to move out temporarily while the water damage is.

Damage to your rental property or personal possessions as a result of vandalism or natural disaster Damage to your property or possessions caused by your tenants Theft of your personal possessions from the rental property. Tenant insurance also known as renters insurance or contents insurance is insurance coverage catered to those that are tenants of a property. If that person were to sue you the tenant insurance would cover any damages or legal fees you had to pay typically up to 1 million.

So whether your neighbour slips on your porch or you hit a stranger with your golf ball on vacation you can rest assured that Square. Coverage applies to your belongings that are both in your home and temporarily away such as when you go on vacation. Plus well make sure that your policy includes just the right amount of content insurance and lists your most prized possessions which could include televisions computers stereos antiques furniture collectibles expensive jewellery sports equipment mountain bikes clothes and more.

Tenant Insurance In Alberta Allstate Insurance Canada

How Does Tenant Insurance Work

Renters Insurance In Alberta Get Tenant Insurance Online Fast

Guide To Alberta Rental Laws Rcpm Solutions

Browse Our Image Of Section 21 Notice Template Simple Cover Letter Template Certificate Templates Being A Landlord

Renters Tenant Insurance For Families Roommates In Alberta Collis Insurance

Alberta Residential Tenancy Agreement Form Download Free Printable Rental Legal Form Template Or Rental Agreement Templates Tenancy Agreement Being A Landlord

Alberta Tenant Application Form Download Free Printable Rental Legal Form Template Or Waiver In Different Edit Rental Application Application Form Application

Climate Change Has Caused Ontario And Alberta Home Insurance Rates To Increase By 64 Per Cent And 140 Per Cent Respectively Ratesdotca

Rental Insurance Cost Per Month Alberta In 2021 Rental Insurance Tenant Insurance Renters Insurance

Joint Tenancy Joint Tenants Alberta Real Estate Law Kahane Law Office

Electrical Service In Some Calgary Homes May Not Be Covered By Insurance Home Insurance Quotes Homeowners Insurance Coverage Homeowners Insurance

Alberta Consent To The Disclosure Of Individually Identifying Health Information Form Download The Free Printable Basic Blank Medic Legal Forms Words Templates

Room Rental Agreement California Free Form Elegant Month To Month Room Rental Agreement Template Rental Agreement Templates Room Rental Agreement Agreement

Editable Rental Room Agreement Template Pdf Room Rental Agreement Rental Agreement Templates Being A Landlord

Renters Insurance In Alberta Get Tenant Insurance Online Fast

Printable Getting Your Security Deposit Back Lawnow Magazine Demand Security Deposit Letter Being A Landlord Lettering Letter Templates

Tenant Insurance A Complete Guide For Renters In Alberta Insurancehotline Com

Sign up here with your email

ConversionConversion EmoticonEmoticon